Software Defined Hardware: Supermicro's Rise Explained

It is hard to believe that it was 13 years ago that Marc Andressen penned his famous blog entitled “Software is Eating the World.” In it he spoke of the disruption that modern software organizations were inflicting on traditional businesses.

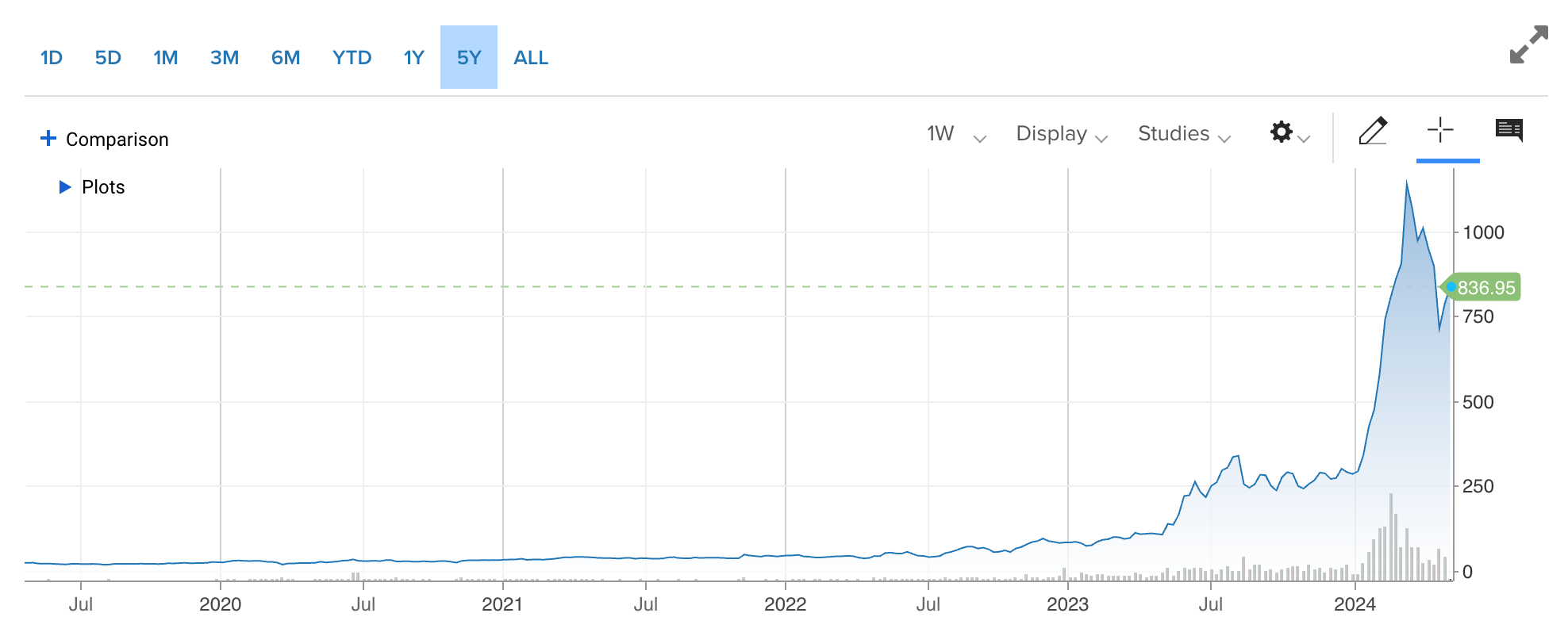

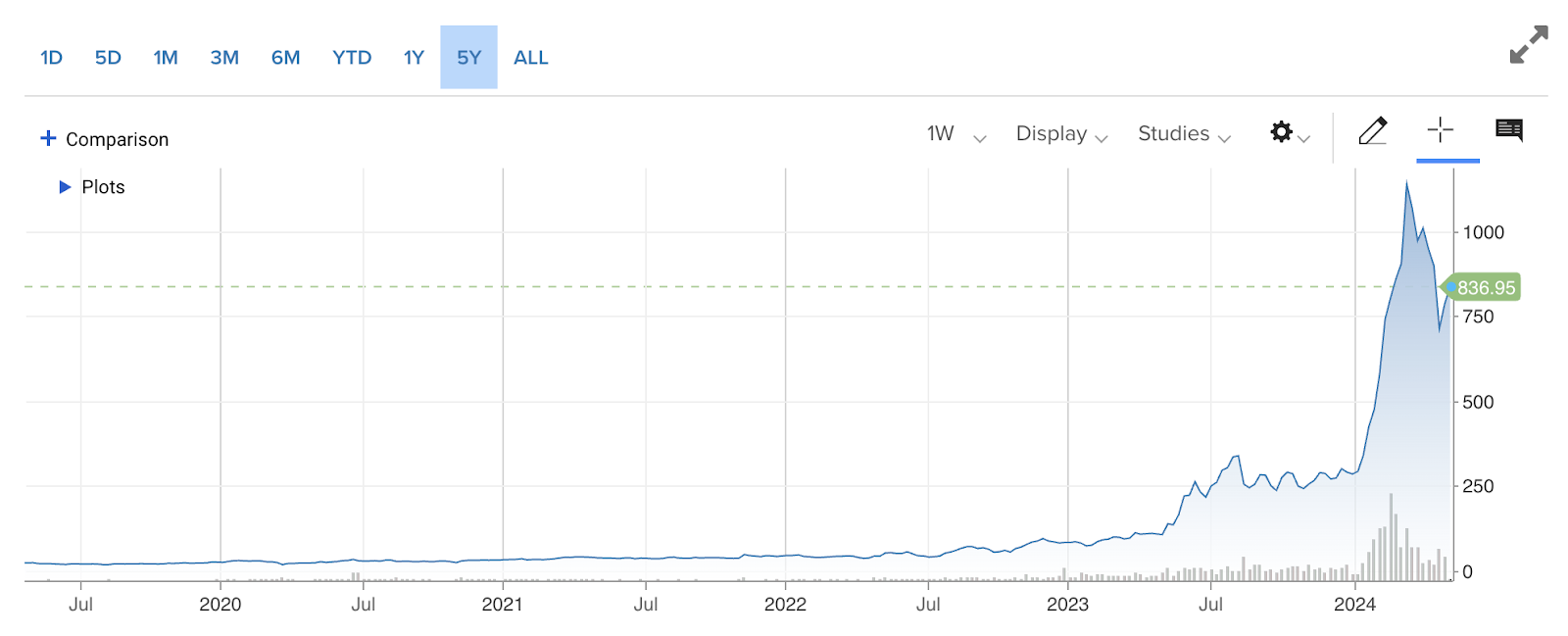

Thirteen years later, even in the face of stratospheric valuations for Nvidia, software continues to eat the world. The evidence can be found in another hardware company’s stock price, one that doesn’t even make GPUs - they simply package them. That stock is Supermicro:

Why Supermicro wins in a software‑defined world

Supermicro, for those that don’t know, is a manufacturer of commodity hardware. They are now the world’s largest player in that space. They compete with Dell, HPe, Lenovo, Western Digital, Seagate and some others. There is no one quite like them, however.

Scale drives cost leadership

First, their volume is massive. That volume has enabled Supermicro to achieve incredible economies of scale. This makes them the low cost provider - which is our second point.

Pricing advantage in large‑volume deals

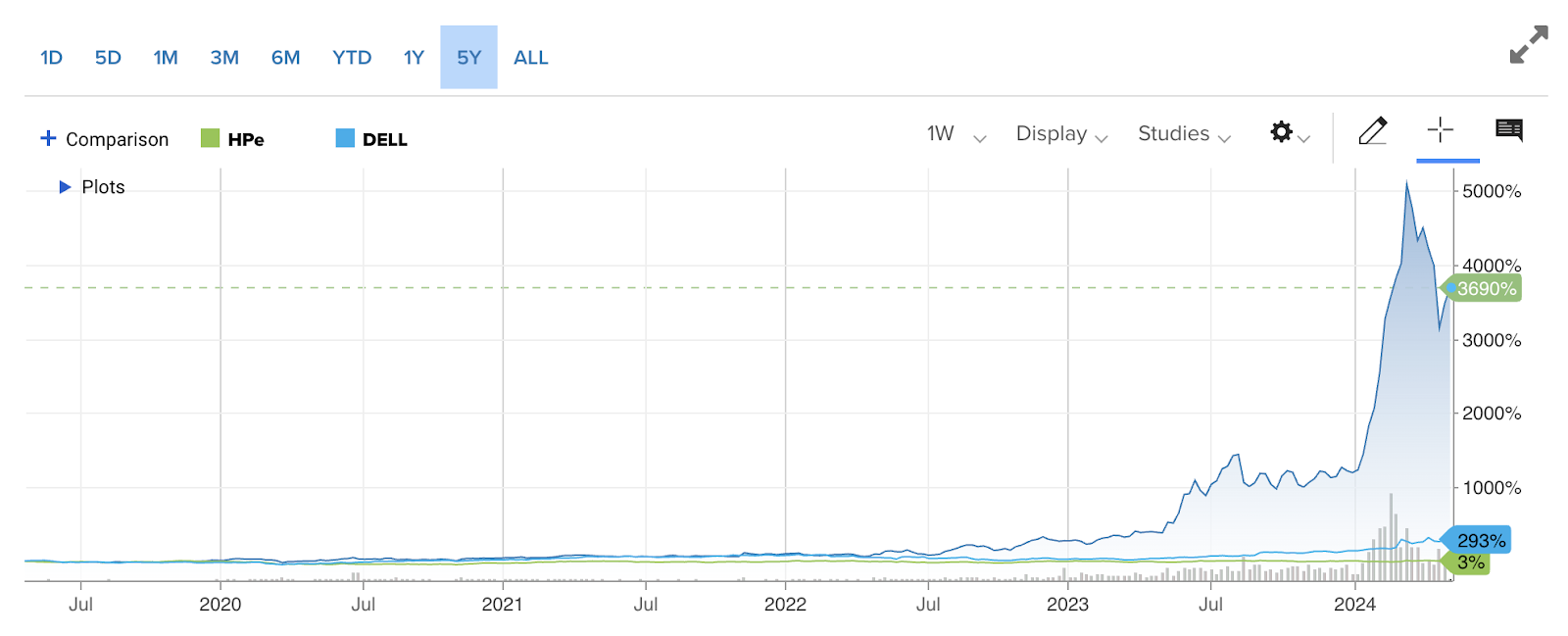

Supermicro’s pricing can’t be beat. That is not to say that Dell, HPe or others don’t win deals, they do - what it says is that if optimizing for the price/performance frontier is a primary consideration and the volume is significant, Supermicro almost always wins. We know, we have been in those large volume deals with them - the other guys know they are going to lose. They talk about the “relationship” or spread FUD around quality and support. It doesn’t matter - that is why Supermicro’s stock price looks like a hockey stick in comparison (yes, you have to look really hard to find them…).

Quality, innovation, and software‑defined neutrality

Third, the FUD around quality and support isn’t real. Again, the proof is in the numbers. You can grow as the low cost provider, but you can’t dominate unless you have strong quality and outstanding support. They do. More importantly, Supermicro is always innovating (just look at what they did with PCI Gen5, 60TB NVMe and the latest generation of GPU technologies). That speed of innovation comes with a cost - there will be bugs. Supermicro gets to stability faster on the latest technologies because they are so aggressive in getting to market. Perhaps the most underappreciated component of Supermicro’s meteoric rise, however, is the move to a world that is software-defined. Indeed, this might be the most important proof point in the Supermicro story. It is ironic to think that software is what is powering the Supermicro rocket, but we will present the case below. Supermicro doesn’t sell software, chips or drives - they package it. They operate as an effective Switzerland for each of these categories. They are partnered with Intel, AMD, Nvidia and plenty of other silicon providers. They are partnered with Micron, Samsung, Kioxa and Solidigm on the drive front. The most important set of partners, however, are on the software side. Supermicro’s lack of conflict with their software ISVs stands in stark contrast to Dell and HPe. Dell and HPe are appliance players first and foremost. They have perverse incentives to push their software products (tied to their hardware appliance-first strategy) even if they are not in the customers best interest. They will only sell you bare metal hardware under extreme duress (like a clear indication they will lose the deal otherwise or a big customer demands it). For example, Dell routinely recommends their ECS appliance - even though it is a decade past its prime - that’s not in the customer’s best interest, it is in Dell’s interest.Supermicro assembles best of breed software providers and pairs them with their hardware. They don’t get in the way of the customer picking the best tool for the job - and that’s incredibly powerful.

Disaggregation favors Supermicro

- This is yet another example of disaggregation but writ large. We talk a lot about disaggregation here. It is the modern way of doing things. The disaggregation of storage and compute drove the current cloud computing cycle. We are seeing the disaggregation cycle at work in the database world where databases are seeing themselves as high-speed query processors and moving away from storage. Supermicro has benefited disproportionately from disaggregating hardware from software. This isn’t to suggest that Supermicro doesn’t have software skills - they do, and in spades. It is just that Supermicro’s software skills are deployed against the problem of creating a great platform for other ISVs. They have superb Linux skills, outstanding networking skills, excellent Kubernetes skills. But those skills are in service of applications, object stores, databases - even the shrinking NFS/SMB players.

The cloud operating model accelerates adoption

- The rise of the cloud operating model is driving a ton of this growth too. Supermicro sells plenty of kit to the hyperscaler market, but they sell the same kit directly to enterprises, colos and also “secondary” cloud providers like Cloudflare. The point is that the cloud isn’t a place, it is an operating model - and one of the core tenants of that cloud operating model is that everything is software-defined. Dumb hardware, smart software. That might be a little harsh, we noted above that Supermicro has software talent - but that is the model that large enterprises seek - maximum flexibility, maximum control through software. Supermicro doesn’t stand between that and so they benefit disproportionately as a result.

Enterprise buying drivers: cost, scale, and flexibility

- Cost. Enterprises want to control costs. We noted that Supermicro’s scale allows them to price far more aggressively than competitors. There is another element as well. By understanding the HW price and the SW price independently, enterprises have more visibility into where the value lies. That will be different in many cases - GPUs have dominated the value equation in recent quarters, but more often enterprises are buying hardware to support a software/data workload. We have written how appliance vendors like to try to obfuscate the value by “combining” your software and hardware. Enterprises see through this and buy HW from Supermicro and software from folks like us.

- Scale and flexibility. One of the follow-ons from the disaggregation points is that the modern workload is more data dependent. That means more storage than compute. How much more varies on the application and the workload. Having the flexibility to move that ratio at will is a game changer and is a key reason that enterprises adopt storage from folks like Supermicro vs. traditional appliance vendors.

Conclusion: the poster child for software‑defined

Hopefully this makes a case for why a hardware company is the poster child for the software defined world in which we live. Supermicro’s success is a function of a lot of things, but a big part of it was the strategic decision to build for software and by doing so they have lapped the field many times over in the last five years (AI helped a lot in the past 12 months…).

Get started with MinIO

So stop buying appliances and get on the software-defined storage train today. You can reach us on the Ask and Expert button, at hello@min.io and/or our community Slack channel.