Mono Clouds vs Multi-Clouds & Hybrid Clouds

What Amazon Web Services has done is truly remarkable. Over the better part of fifteen years they have built a business with an annual run rate in excess of $45B. Underpinning that remarkable growth is storage – specifically S3, launched back in 2006. S3 revolutionized the storage industry and the S3 API is now the standard in the cloud, replacing the POSIX API and marking the beginning of the end for file and block. At this point, AWS is the dominant provider of public cloud infrastructure as a service, dwarfing offerings from the likes of Google, Microsoft, IBM and Oracle.

AWS likes to remind analysts that they are just getting started and that they have just scratched the surface of the overall available market. This is true in more ways than one – and behind the code words of “we have a ton of growth opportunities…” lies an uncomfortable truth – that AWS, barring significant changes, will pin their growth hopes to the public cloud - leaving the door open to those companies that can operate in a multi-cloud world.

Let us explain.

First off, let’s define the cloud. The “cloud” can exist on prem, at the edge, on a Kubernetes distro, or yes, in the public cloud. The cloud is a mentality, not a place. The cloud is a collection of technologies, a way of approaching the challenges of scale, security, performance and resiliency. It has nothing to do with location.

If we agree on that definition (and we should) then we have the foundation of our analysis - that the cloud market encompasses – public, private, edge, Kubernetes.

AWS is the dominant public cloud. Most published reports have them at around 32% with Azure at 20%, Google at 10% and the rest scattered across a very long tail of providers. We have some of our own data on this (based on host counts in the cloud) and we have AWS higher but our figures for Azure and Google are about the same. Either way, AWS is THE major player in the public cloud.

As we have noted, the public cloud is one of many. Most analyst work has the public cloud and the private cloud at about the same size. The CNCF actually has the private cloud growing a little faster than the public cloud, but for the purposes of this discussion – let’s put them at 45% each. That leaves another 10% for the emerging Kubernetes distributions (VMware Tanzu, Red Hat OpenShift as the big players with HPE Ezmeral and SUSE/Rancher a distant third) and for the edge cloud.

These numbers are open to debate – we have not seen anything that feels “definitive” to us (but let us know if you have). Nonetheless, they are directionally correct.

Here is where it gets interesting. If AWS is 32% (or 32/100) of the public cloud and the public cloud is 45% (or 45/100) of what we are generally calling the cloud then they are at only 14% (32*45/10000) of the OVERALL cloud opportunity.

While the public cloud continues to grow robustly, AWS’s head start is losing some steam and their market share has been dropping a few percentage points each year. Further, the private cloud is growing at the same pace – but AWS does not have nearly the play here – Outpost is a niche product and is designed for companies that are “all AWS, all the time.” That market is drying up quickly as the multi-cloud becomes the primary architecture for every large enterprise – for the reasons of lock-in, risk, economics, performance and security. To date, AWS doesn’t have a play at the edge and doesn’t have a play on Kubernetes distributions like Tanzu and OpenShift.

Don’t get us wrong. A $45B run rate is simply amazing. But the overall market is much larger and the growth trajectory of the edge and Kubernetes distributions are higher than the public cloud – even though the dollars are not there right now. All those VMware workloads are going to move to Tanzu over time. OpenShift is a platform in its own right. The edge cloud is in its infancy.

Right now, there is no real AWS roadmap to expand the presence into other clouds and onto the private cloud Kubernetes distributions.

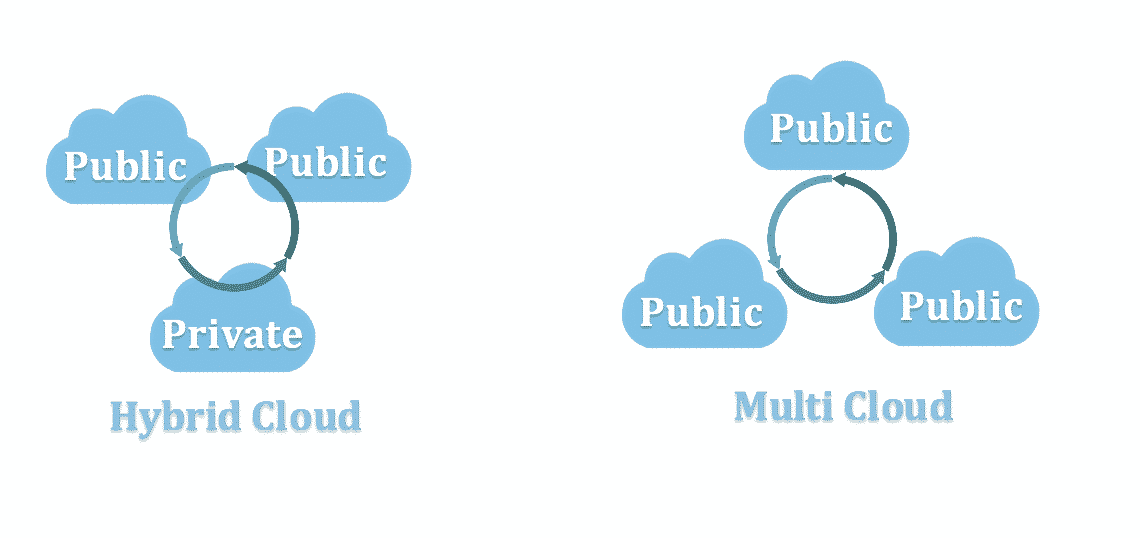

Our assertion is that to win the cloud you have to win everywhere. That means you have to win the public cloud, the private cloud, the Kubernetes distributions and the edge. Within the public cloud you need a multi-cloud play. On the private cloud, Kubernetes and the edge you need a hybrid cloud play.

This argument logically extends to include cloud storage (our business), in that it also needs to be Kubernetes native, high-performance, software-defined and object based. AWS checks many of those boxes, which is why it is so successful, but it is a service, not a software defined product. That is why you don’t find it at the edge, on Kubernetes distributions, on other public clouds or on the private cloud. The changes AWS would need to make are very significant to field an offering there. We are not going to be the ones to say they can’t make those changes – but they will be really hard and if they don’t – they will remain the market leader in public cloud but miss out on the far bigger cloud (public, private, edge, Kubernetes) opportunity.

With AWS focused on the public cloud market, that opens the door to companies like MinIO.

MinIO is built for the multicloud and runs on every cloud today. That includes more than 500K hosts across Google, Azure and AWS. That includes every major Kubernetes distribution - MinIO was even a design partner for Tanzu. MinIO’s binary is less than 100 MB and is the standard at the edge. Finally with well over a 1M Docker pulls per day, MinIO has become the standard for the private cloud - particularly the modern, performance oriented workloads where we outperform even AWS.

MinIO has a clear path to be the leader in cloud storage. Don’t take our word for it though, try it out for yourself. Run it in a cloud, run it across multiple clouds, run it at the edge. Run it on Tanzu. Just run it - you will see what we are talking about.